Bear Put Spread

Introduction

You have been researching a stock and have formed a bearish opinion on its value, forecasting that it will fall in price over the coming months. You would like to limit your risk and are comfortable paying money to establish this position.

Building on your foundational knowledge of call and put options as well as the risks and benefits of single-leg options trades (buy call, sell call, buy put, sell put), you recognize that a two-leg trade, or spread trade, achieves the objectives you have outlined.

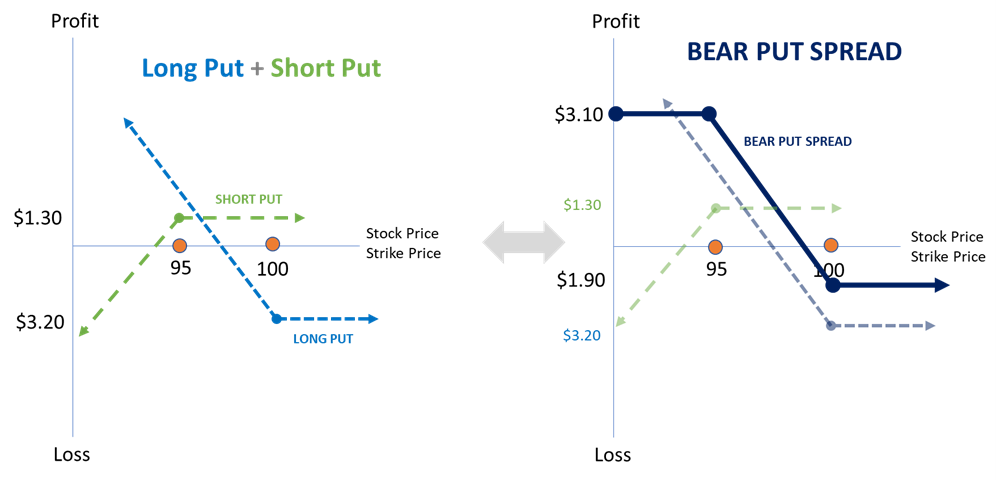

Specifically, buying a put expresses your bearish sentiment and achieves the goal of limiting your risk exposure to the upside. By selling a lower strike put, you offset some of cost of the long position and trade off some of the downside gain potential.

The combination of a long put and short put is referred to as a spread trade. Risks and benefits of each individual option component, or leg, offset each other to a degree in order to create the desired position and range of possible outcomes.

What is a Bear Put Spread?

A bear put spread consists of one short put with a lower strike price and one long put with a higher strike price:

- Short 1 XYZ 95 put

- Long 1 XYZ 100 put

Both puts have the same underlying stock and the same expiration date.

A bear put spread is established for a net debit(or net amount paid) and profits from a declining stock price.

Both maximum profit and maximum risk (loss) are limited and known.

Worth noting: The “bear put spread” strategy is also known as a “debit put spread” and as a “long put spread.” The term “bear” refers to the fact that the strategy profits with bearish, or falling, stock prices. The term “debit” refers to the fact that the strategy is created for a net cost, or net debit. Finally, the term “long” refers to the fact that this strategy is “purchased,” which is another way of saying that it is created for a net cost.

Example

- Short 1 XYZ 95 put at $1.30

- Long 1 XYZ 100 put for $3.20

In our example, assume stock XYZ is currently trading around $101.

We sell 1 XYZ 95 put for a total of $130 (1 x 100 multiplier x $1.30) and buy 1 XYZ 100 put for a total of $320 (1 x 100 multiplier x $3.20).

In this example the bear put spread (long put + short put) positions were established for a net debit of $190 ($130 – $320 = –$190).

Outcome 1: Profit

With a bear put spread position, potential profit is limited because of the short put.

First, let’s recall the formulas for individual options positions:

Put Options:

If K – S > 0,

Long Put Profit = Strike Price – Current Stock Price – Net Premium Paid

Short Put Loss = – (Strike Price – Current Stock Price – Net Premium Received)

If K– S < 0,

Short Put Profit = Net Premium Received

Long Put Loss = Net Premium Paid

To calculate our profit on the position we established, we use the formula:

Profit = Profit/Loss on Short Put + Profit/Loss on Long Put

The maximum profit of the bear put spread is limited to the difference between the strikes minus the net premium paid. This maximum profit is realized if the stock price is at or below the strike price of the short put (lower strike).

Example

Stock XYZ is trading at $101 and you establish a bear put spread for a $1.90 debit.

- Short 1 XYZ 95 put for $1.30

- Long 1 XYZ 100 put at $3.20

A week later, stock XYZ is trading lower at $90.

*Unrealized profits are those that potentially exist; realized profits occur when you close out or trade out of the position.

Outcome 2: Loss

Let’s assume we are incorrect in our sentiment, and the stock price rises. To calculate our loss on the position, use the following formula:

Loss = Profit/Loss Long Put + Profit/Loss Short Put

Remember, the stock price cannot trade below $0. Maximum loss is equal to the net premium paid.

In our example:

Max Loss = Net Premium Paid = $1.90 per share or $190 total loss (not including transaction costs and fees)

Example

Stock XYZ experiences unexpected news and is now trading higher at $110.

*Unrealized profits are those that potentially exist; realized profits occur when you close out or trade out of the position.

Outcome 3: Breakeven

The breakeven price calculated on a per share basis for a bear put spread is equal to the higher put strike minus the net premium received.

Breakeven Price = Higher Put Strike – Net Premium Paid

Example

- Short 1 XYZ 95 put for $1.30

- Long 1 XYZ 100 put at $3.20

Breakeven Price = $100 – $1.90 = $98.10

At-A-Glance

Strategy

- Bear Put Spread

Alternative Name

- Debit Put Spread

Pre-Requisite Strategy Knowledge

- Long Put

- Short Put

Legs of Trade

- 2 legs

Sentiment

- Bearish

Example

- Short 1 XYZ 95 put

- Long 1 XYZ 100 put

Rule to Remember

- Long put strike must be higher than the short put strike, expirations must be the same

Max Potential Profit (GAIN)

- Limited: Difference between the strikes – Net Premium Paid

Break-Even Point

- Higher put strike - Net Premium Paid

Max Potential Risk (LOSS)

- Limited: Net premium paid

Ideal Outcome

- XYZ price declines to or below the lower put strike

Margin Requirement

- Yes

Early Assignment Risk

Early assignment risk applies to short options positions only.

American options can be exercised on any business day, and the holder of a short stock options position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment must be considered when entering positions involving short options. Early assignment of stock options is generally related to dividends.

The long put (higher strike) in a bear put spread has no risk of early assignment.

The short put (lower strike) does have such risk.

If the stock price is below the strike price of the short put in a bear put spread (the lower strike price), an assessment must be made if early assignment is likely. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated in two ways:

- First, the entire spread can be closed by selling the long put to close and buying the short put to close.

- Alternatively, the short put can be purchased to close and the long put can be kept open.

If early assignment of a short put does occur, stock is purchased. If a long stock position is not wanted, the stock can be sold either by selling it in the marketplace or by exercising the long put. Note, however, that whichever method is chosen, the date of the stock sale will be one day later than the date of the stock purchase. This difference will result in additional fees, including interest charges and commissions. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position.

Potential Position Created at Expiration

There are three possible outcomes at expiration: the stock price can be at or above the higher strike price, below the higher strike price but not below the lower strike price, or below the lower strike price.

- If the stock price is at or above the higher strike price, then both puts in a bear put spread expire worthless and no stock position is created.

- If the stock price is below the higher strike price but not below the lower strike price, then the long put is exercised and a short stock position is created.

- If the stock price is below the lower strike price, then the long put is exercised and the short put is assigned. The stock is then sold at the higher strike price and purchased at the lower strike price, resulting in no stock position.

Charts

-Powered by The Options Institute