Select a Contract When Buying an Option: Consider Key Elements

Introduction

When selecting an options contract, it comes naturally for many of us to purchase an OTM, even a deep OTM option for the lower premium paid. Here, we will discuss the trade-offs of selecting an options contract.

How Do We Measure Liquidity?

In a used car market, some vehicles will sell faster than others. In financial jargon, liquidity is important in trading activities for buyers and sellers.

Maybe you have found that options trading is quite different from stock trading and encountered the following situations:

- It's harder to move in or out of option positions using limit orders than trading stocks.

- You have watched your position turn into a loss and your sell order can't be filled in a timely manner.

- The negative slippage is significant.

Trading a liquid product results in much faster executions given the availability of many market participants willing to either buy or sell your position at the current market price. You can enter and exit your positions quickly—with less slippage (the difference between the expected price of a trade and the price at which the trade is executed). Generally, stocks have higher liquidity than their options, making them easier to buy and sell than options.

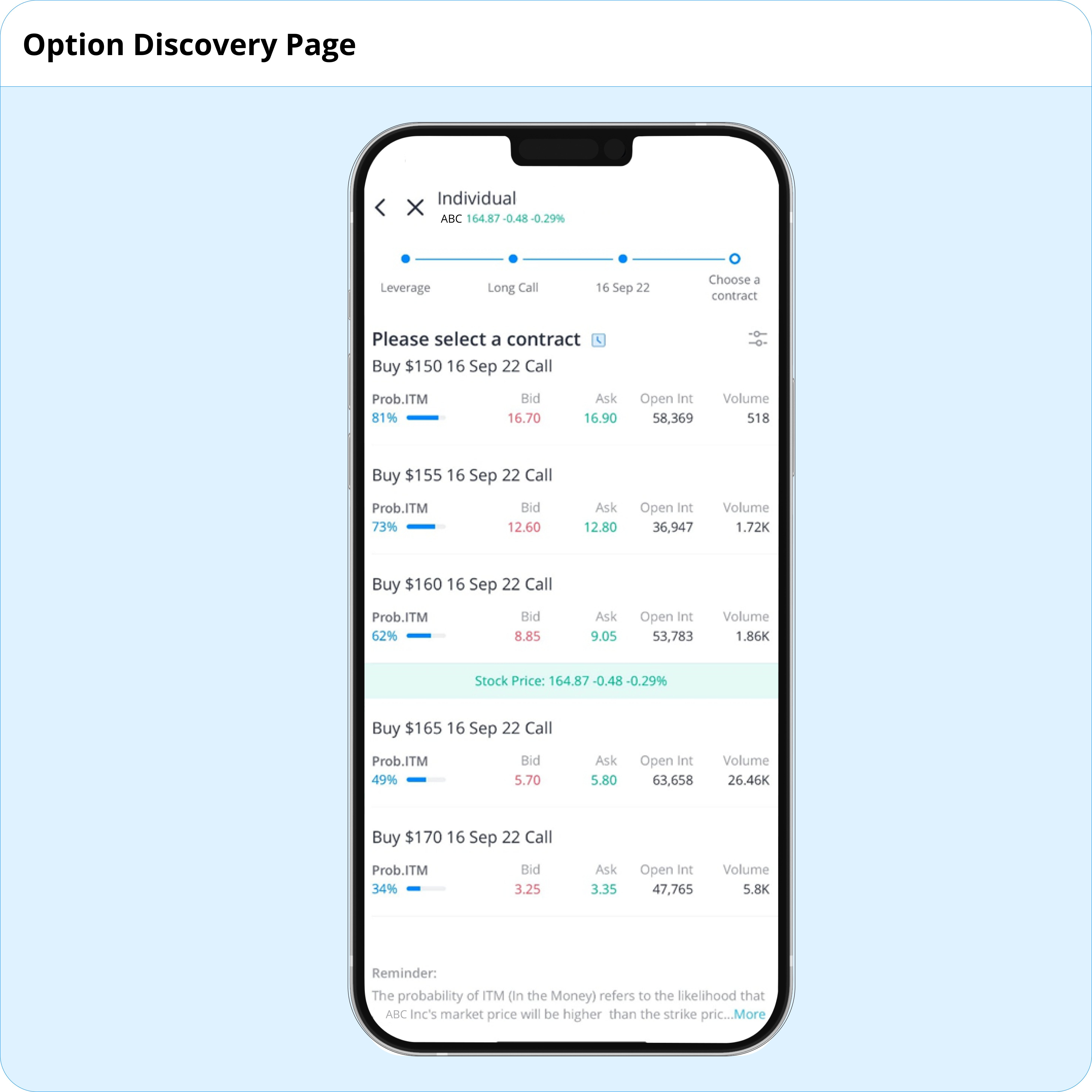

Two important indicators can help you size up liquidity in options trading: volume and open interest.

- The daily volume of options is the number of contracts traded on a particular day. For instance, a ticker that sees a daily volume approaching 1 million contracts is among the more liquid option contracts. On the other hand, if just a few hundred contracts are traded, the market may not have much liquidity.

- Open interest is the total number of open options contracts on a particular day.

All other things being equal, ATM options are usually among the most actively traded. It is primarily because uncertainty is higher for ATM options than ITM or OTM options. For ATM options, even a slight price movement in either direction can tip the option from ATM to ITM or OTM.

A higher volume and open interest typically lead to a tighter bid-ask spread. Let's dig into how a narrower or broader bid-ask spread affects your profit.

Why Does the Bid/Ask Spread Matter?

The bid is the highest price a buyer in a market is willing to pay for an asset/security, and the ask is the lowest price a seller is willing to accept. The difference between the ask and bid prices is called the "bid-ask spread" or simply the spread.

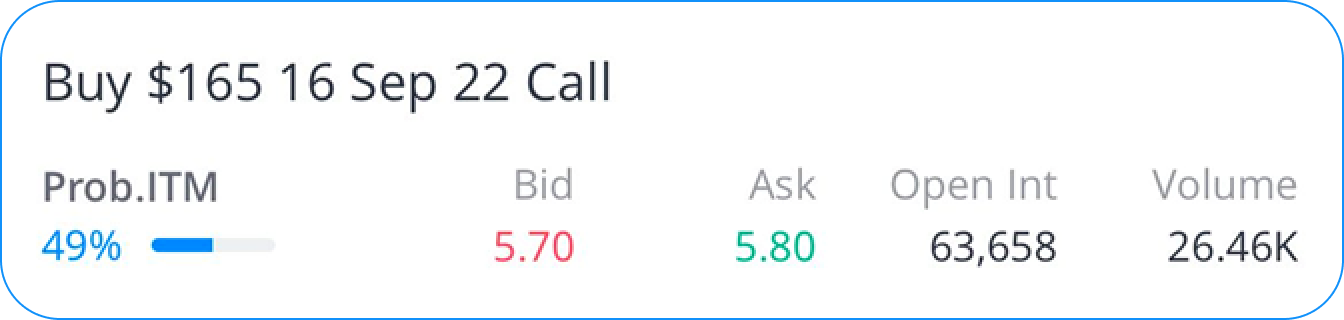

Why is it important to consider the bid/ask spread? Because in order for a buyer to realize a profit, the price of the stock has to rise more than the bid/ask spread. To explain further, let's use the example below:

Suppose "ABC $165 Sep 22 Call" is trading at 5.70 bid and 5.80 ask. If a bullish day trader buys the call option at the ask price of $5.80, then tries to sell it minutes later, he may only be able to do so at the bid price of $5.70. That incurs an immediate loss of $0.10 per contract. While a loss of $0.10 on a $5.08 option may be reasonable, the potential loss increases if the bid/ask spread widens.

If the ask price remained at $5.80, but the bid price dropped from $5.70 to $4.00 for a lack of demand, the same transaction will have an immediate loss of $1.80 per contract. Slippage is much higher in this case.

Since the volume and open interest is higher in ATM options than in OTM/ITM options, the spread for ATM options is generally tighter. The tighter the spread, the higher the chance of getting the order filled at a better price or entering/exiting trade more quickly. In conclusion, it is important to consider the bid/ask spread when trading options, as this can significantly impact the trade outcome.

How to Assess the Odds of Winning

Maybe you often vision a perfect scenario after buying a call or put option: the stock price moves exactly as predicted with a nice profit. Unfortunately, it doesn't always play out that way.

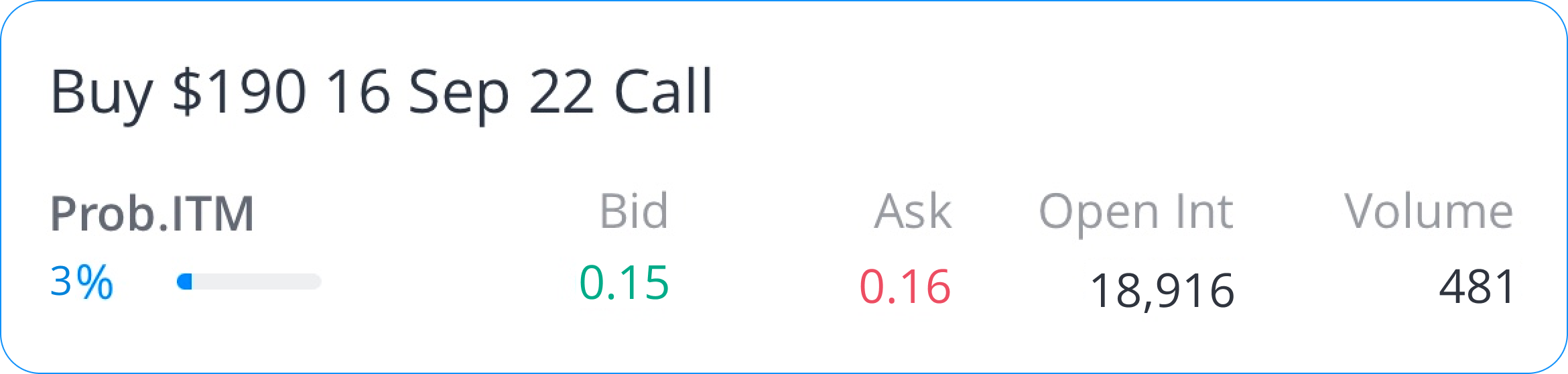

Probability is generally defined as the likelihood of an event happening within a specific period, expressed as a percentage. With options probability, the event may be the likelihood of an option being in the money (ITM) or out of the money (OTM), and the time frame might be the time until the expiration date. Webull users can refer to the "Prob. ITM" number to estimate the probability of an option being in the money at expiration.

Suppose you buy an "ABC $190 Sep 16 22 Call" because you're bullish. Even though you only spend $16 on this trade, there is only a 3% chance that your option will expire in-the-money, which translates to a 97% chance that your option will expire worthless. Of course, you can sell to close your position anytime before expiration to realize any potential profit or loss accrued.

NOTE: The calculation of ITM probability is based on the probability distribution of the stock's market price. It represents a theoretical value for reference only and does not guarantee the probability or event of an option actually becoming ITM. Even if an option has a Probability ITM of 100%, there's no guarantee the option will finish ITM at expiration. There's always a chance, even if it's a small one, that the underlying security could move big enough that the deep ITM option converts into an OTM option.

Consider Your Options

Now, you understand the three essential elements influencing your risk and reward profile in options trading. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance.