Consumer Sentiment and the Stock Market

What is consumer sentiment?

Consumer sentiment refers to the overall attitude or feeling of consumers towards their own financial health and the economic situation. It can be measured through surveys, polls, and market research, and is often used as a leading indicator of consumer spending and economic activity.

Consumer sentiment is primarily measured through the Consumer Confidence Index (CCI) and the Michigan Consumer Sentiment Index (MCSI).

CCI vs. MCSI

The Consumer Confidence Index is a measurement of how positive or negative consumers are feeling about economic performance in general. This survey is done by the Conference Board. Similarly, the Consumer Sentiment Index is a measurement of how positive or negative consumers are feeling about their personal economic circumstances. This national telephone survey is done by the University of Michigan.

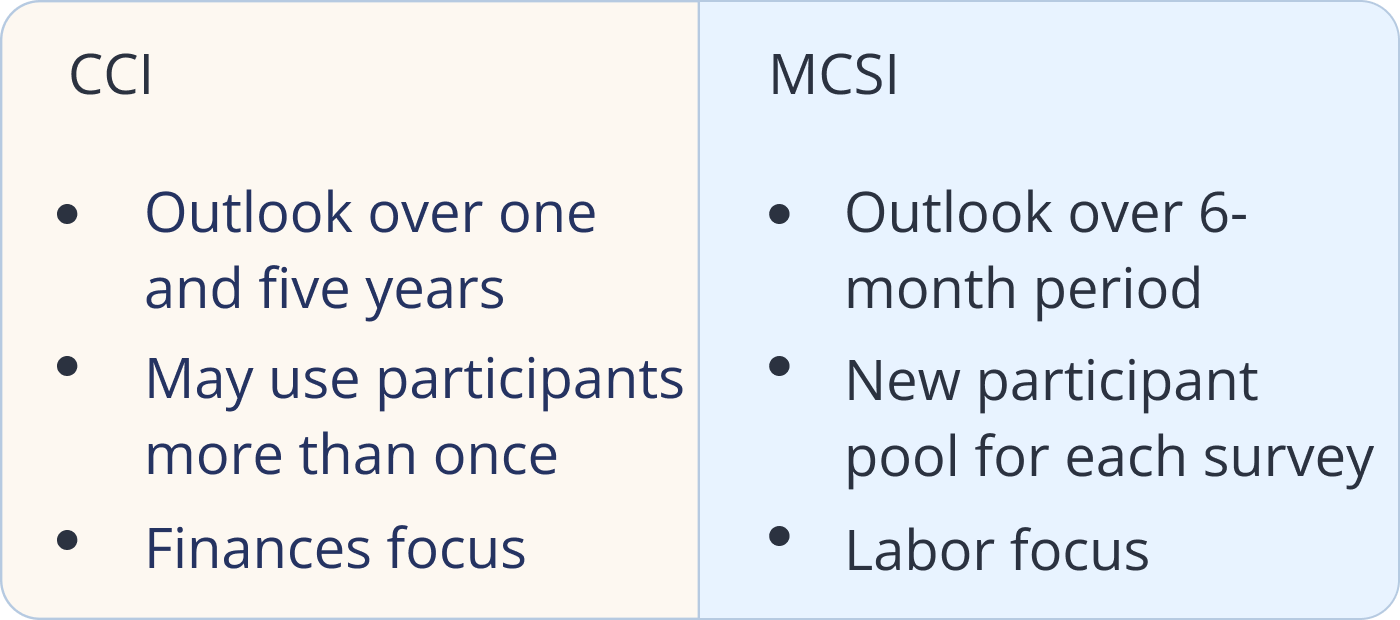

While both surveys are alike in many ways, they do have subtle differences. The questions on the Confidence survey focus more on labor, while the Sentiment survey tends to focus more on consumer finances. Some other key differences:

Both indexes can give investors a good idea of how the general population is feeling about certain aspects of the economy. Nevertheless, the public tends to favor the Sentiment Index over the Confidence Index—the Sentiment Index’s focus on personal finance is a better reflection on consumer spending in the near future, whereas the results of the Confidence Index tend to reflect recent conditions that have already passed. These reports tend to be released much faster than other indexes that can indicate economic performance, which is why they tend to be early signs of where the markets are headed.

What makes these indexes important?

By understanding the way consumers feel about the current state of the economy, we can assess their spending habits and better determine economic performance overall. It can show the current demand for goods and services, and if demand is high, this can be a positive thing for stock prices. Recently, consumer confidence has improved with gas prices starting to level out and inflation beginning to rise slower than previous months. The Consumer Confidence Index also reported that expectations regarding inflation for the new year are lowering, another sign that consumer outlook is improving.

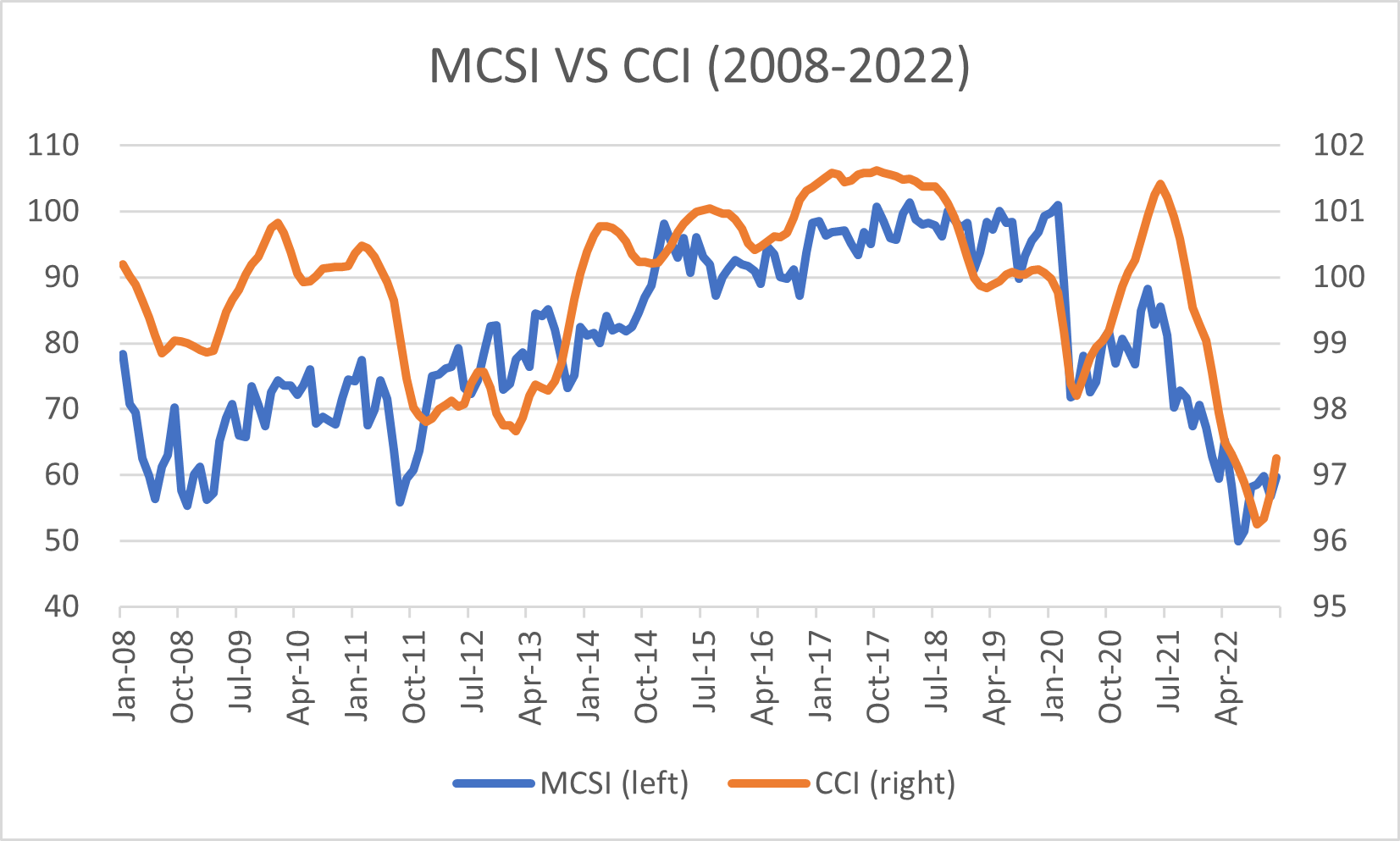

Data Source: University of Michigan & The Conference Board

Although, we aren’t quite out of the clear yet. Currently, the US is still in a bear market, and the Fed is continuing to increase interest rates in hopes of combating inflation. Despite a looming recession, the Fed has stated that rate hikes may not be over. Still, consumers are hopeful that we may have gotten through the worst of it already. Knowing that the general population is feeling positive about the near future of the economy is a good sign for the markets and can give investors hope for their portfolio performance in the coming months.

How the Economic Data Impacts the Market

The data can directly coincide with how the markets are performing. The results of these surveys tend to be a good (or bad) sign for the current state of the economy. Other reports based on official numbers (as opposed to just the feelings of consumers), such as CPI, tend to reflect sentiment and confidence. This could be because if consumers are confident, they are more likely to spend money and feed it back into the economy.

Since the majority of consumption is done by the general public, the spending habits of consumers are extremely important to economic growth. The data provided by the Consumer Sentiment Index and the Consumer Confidence Index provide consequential insight into what we should expect from the markets. If consumers do not have a positive outlook on the current state of the economy, this likely means they are in a state of uncertainty when it comes to their finances, and in turn will spend less. When consumers aren’t spending as much, businesses may struggle and need to cut production, which can lead to supply chain issues and lower sales. This will cause a direct hit to their stock prices, and investors can end up taking significant losses.

How Should Investors React?

When data from the confidence or sentiment indexes are released, it can show investors how others are currently feeling and influence their feelings as well. But, you can always make your own guess when it comes to stock performance by also considering market news and your personal experiences. When index results are released, investors should take these numbers into consideration alongside metrics from other surveys, the Fed report, technical and fundamental analysis, and your own market insight. Also, keep trends in mind when doing your data analysis—trends can be a great way to determine what the next market moves might be. While there is no right or wrong way to react to the release of the confidence and sentiment reports, it’s crucial to always use your best judgement and contemplate how you can use these numbers alongside your trading strategy to yield the best results. Remember, every investment involves risk, and there is no way to guarantee that your trade will turn a profit.

The Bottom Line

Consumer sentiment and confidence are two crucial indicators of the current state of the economy. Investors should take the results of the Consumer Sentiment Index and the Consumer Confidence Index into consideration when deciding on future trades and investment strategies, as consumers are the driving force behind economic performance and thus have the potential to sway the markets.