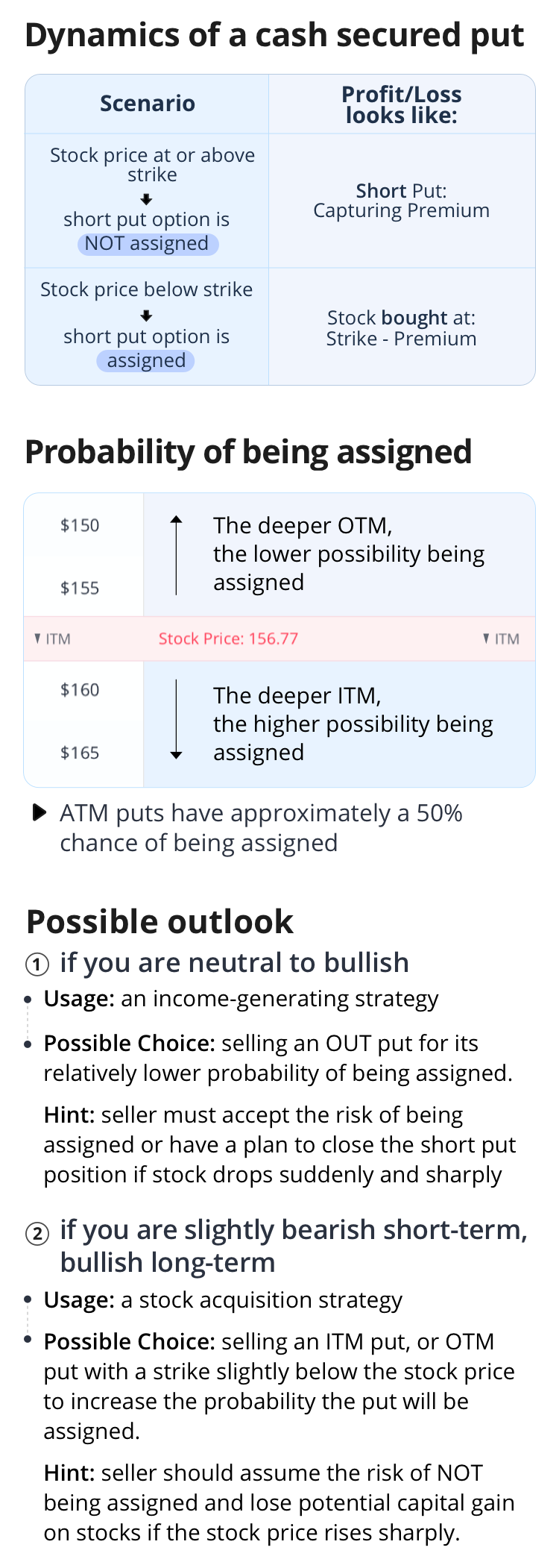

Selecting a Strike Price of Cash Secured Put

Here is an infographic about selecting a strike price for a cash secured put strategy.

AuthorWebull Learn

0

0

0

Disclaimer: Options are risky and not suitable for all investors. Investors can rapidly lose 100% or more of their investment trading options. Before trading options, carefully read Characteristics and Risks of Standardized Options, available at Webull.com/policy. Regulatory, exchange fees, and per-contract fees for certain option orders may apply.

Share your ideas here…

Lesson List

1

Trading Cash Secured Put on Paper Trading

2

Selecting Expiration for a Cash Secured Put Strategy

Selecting a Strike Price of Cash Secured Put

4

Selling an OTM or ITM Cash Secured Put?

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2026 Webull. All Rights Reserved