FOMC Meeting and the Fed Funds Rate

FOMC Meeting: What and When

The Federal Open Market Committee, or FOMC, typically meets about every six to eight weeks and the meetings are announced in advance. At the meetings, the FOMC members discuss the current economic conditions and outlook. They also consider whether to adjust the federal funds rate and other monetary policy tools in light of these conditions.

The FOMC issues a policy statement following each regular meeting that summarizes the Committee's economic outlook and the agreed upon policy decision. The Chairman holds a press briefing after each FOMC meeting. However, the minutes of regularly scheduled meetings are not released until three weeks after the date of the policy decision.

Click here to check the earnings calendar on Webull.

The FOMC Meeting and the Federal Funds Rate

The FOMC meeting draws attention due to the federal funds rate. During a meeting, members of the Federal Reserve review data on economic growth, inflation, employment, and other indicators. They use this information to make decisions about monetary policy. One of the main decisions made during an FOMC meeting is the target for the federal funds rate, which is the interest rate that banks charge each other for overnight loans.

When the economy is overheated and the inflation level is too high, the Federal Reserve will typically raise the rate to cool down the economy and lower inflation. When the economy is sluggish, the Federal Reserve will typically lower the rate to stimulate the economy.

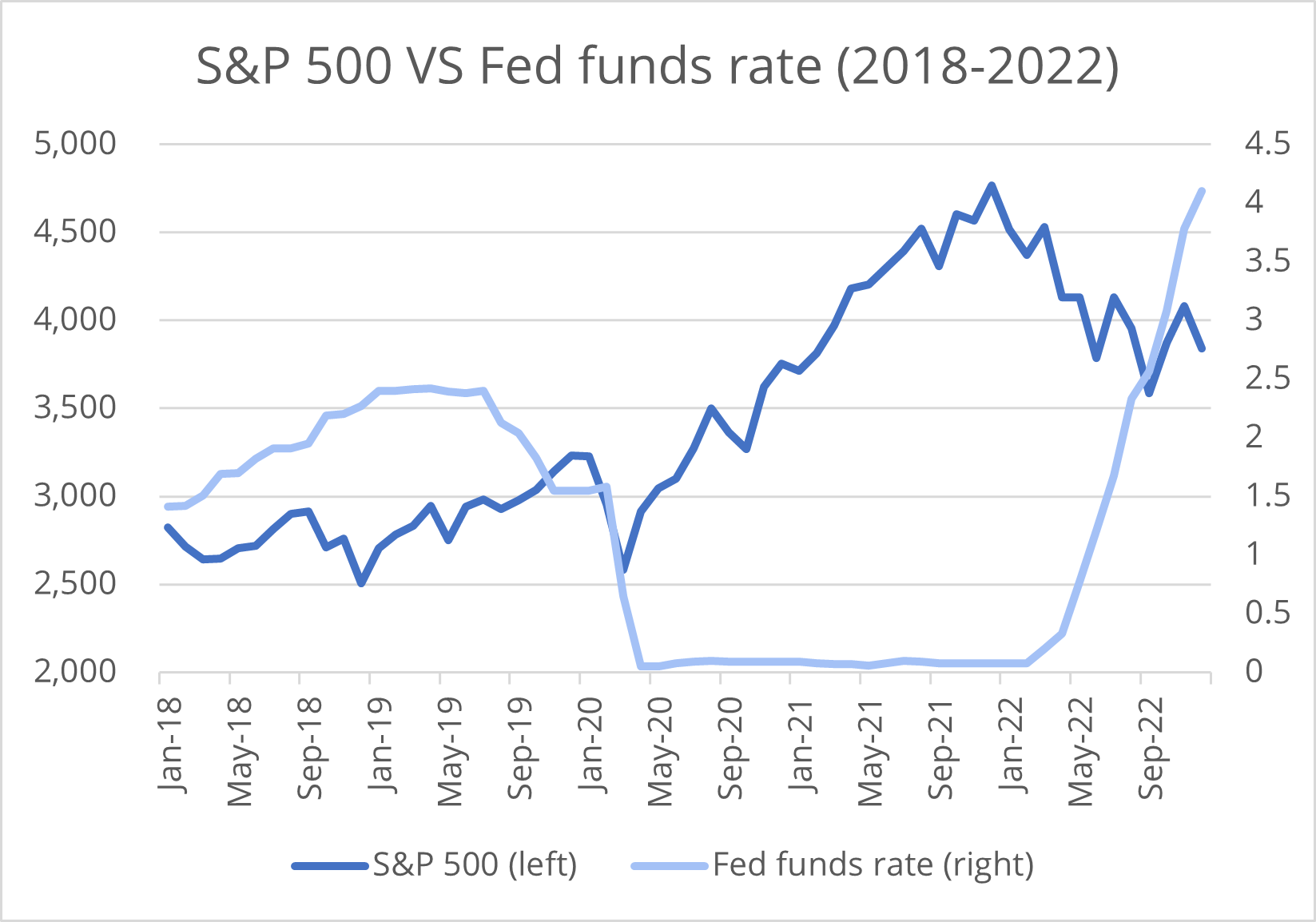

As shown in the chart below, the inflation rate has accelerated since early 2021. The Fed responded by approving their first funds rate increase of 25 basis points in March 2022, with more aggressive hikes in the following meetings.

Federal Funds Rate and the Stock Market

If the FOMC decides to raise the federal funds rate, it can lead to a sell-off in the stock market as investors may see it as a sign of tighter monetary policy and potentially weaker economic growth. On the other hand, if the FOMC decides to lower the federal funds rate, it can lead to a rally in the stock market as investors may see it as a sign of a looser monetary policy and potentially stronger economic growth. The market's reaction to the FOMC meeting and the release of the Fed minutes can be quite volatile, and it is important for investors to pay close attention to the details of the minutes.

As shown below, the S&P 50 index is inversely related to the Fed funds rate. When the Fed rate was lowered to stimulate the slowly growing economy impacted by the pandemic, the S&P 500 index nearly doubled in a year and a half. When the rate hike began in 2022, the index shrank rapidly.

When and where will the rate hike stop? Some economists believe that the Fed funds rate will be above 5% for most of 2023. However, there is still hope that the Fed may keep the rate steady after February 2023.

The Bottom Line

The FOMC adjusts the pace of economic growth by increasing or decreasing the Fed funds rate and conducting other monetary policies. It’s important for investors to keep up with the FOMC meeting schedules and decisions and make informed trading decisions based on economic outlook.