Equip Your Trades With Continuation Patterns

What Are Continuation Patterns?

Continuation patterns mark a period of temporary consolidation before continuing in the direction of the prior trend. Given that the price trend usually will continue when continuation patterns form, traders wait for a breakout to enter.

In this lesson, we will approach some common continuation patterns including flags, pennants, and rectangles.

Identify And Trade With a Continuation Pattern

Continuation patterns often appear in consolidation after a sharp increasing or decreasing trend. During consolidation, investors can connect several swing highs for an upper trendline and connect swing lows for a lower trendline against candlesticks. Then, they could identify the pattern based on the range between the two trend lines and develop trading strategies.

Bullish flag pattern

Formation

A bullish flag pattern consists of two parallel descending trendlines which make the consolidation period look like a floating banner. There could be an upward trend before and after consolidation. The vertical distance between the lowest swing low in the first uptrend and the highest swing high is seen as a flagpole.

Trading Strategies

- Entry: For a bullish flag, a break above the upper trendline indicates that the previous advance is going to resume. As the example shows, swing traders may buy at $67.57 and expect a rise. To avoid a false signal, investors could be more prudent to enter after the initial breakout.

- Stop Loss: Traders typically figure the swing low closest to the breakout as a stop loss point. They may stop loss at $61.81.

- Take profit: Some optimistic traders set their take-profit prices based on the flagpole. The price difference between the base and the peak of the flagpole, $63.88 minus $54.70 in the example, stands for their ideal profit. The cost basis of $67.57 adding the profit of $9.18 equals $76.75, which could be the take-profit price.

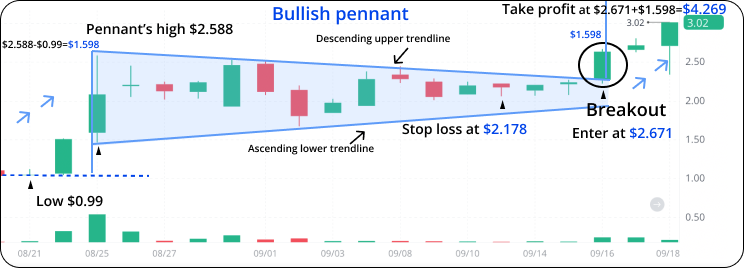

Bullish pennant pattern

Formation

A bullish pennant has a similar outline to a bullish flag, except for the range between the two trend lines shrinks as the pattern matures. This makes its shape look like a symmetrical triangle pattern with fewer candlesticks rather than a flag.

Trading Strategies

- Entry: The candlestick breaks over the upper trendline at $2.671 in the example. An investor may enter a long position here or on the second day when he/she confirms the signal.

- Stop loss: A recent swing low of $2.178 could be set as the stop-loss price.

- Take profit: There is a difference of $1.598 between the base of the flagpole ($0.99) and the pennant’s high ($2.588). Hence, the take-profit price could be $4.269 (The entry price $2.671+profit $1.598).

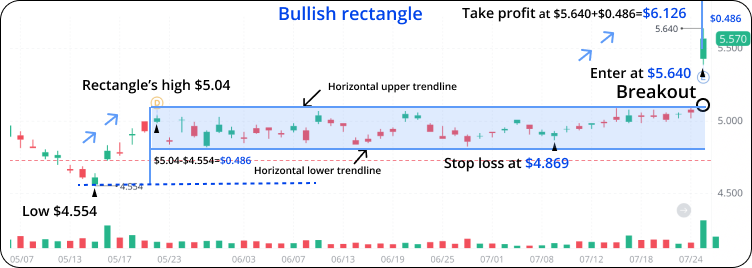

Bullish rectangle

Formation

A rectangle pattern takes shape between horizontal support and resistance levels. A bullish rectangle pattern starts with and leads to an uptrend.

Trading Strategies

- Entry: In the example below, swing traders may enter around $5.640 after the price climbs above the resistance level.

- Stop loss: A recent swing low of $4.869 could be set as the stop-loss price.

- Take profit: Rectangle’s high minus the first uptrend’s swing low is the expected profit, $0.486. So, the take-profit price could be $5.640+$0.486=$6.126.

The Bottom Line

In most cases, continuation patterns may predict a resumption of the preceding price trend.

Swing traders may draw on such patterns to find three key trading points—entry, stop loss, and take profit. Meanwhile, advanced investors might choose to combine indicators analysis to dilute trading risk.

Data disclaimer: Technical analysis data and indicators are provided by Trading Central. Trading Central is a separate entity, unaffiliated with Webull Financial. Webull is not responsible for the accuracy or completeness of data provided by Trading Central. All data are provided for informational purposes only, and are not intended, and should not be construed, as investment advice or recommendations.