A Basic Guide to Understanding Open Interest

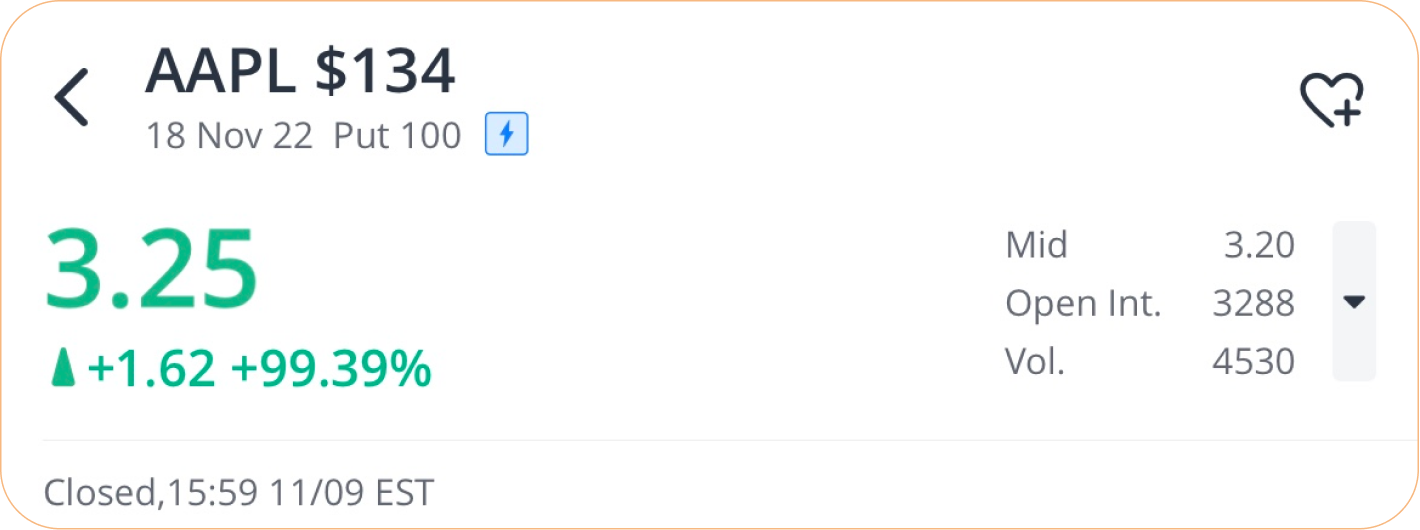

Several different metrics are shown on the Webull options quote page. Open interest is one of the most useful metrics for option traders, and significant change in this indicator alert you to unusual option activities.

What is open interest?

When trading stocks, the number of outstanding shares is generally fixed. In contrast, there is no upside or downside limit in the number of option contracts that can exist for any underlying security.

Open interest refers to the total number of options contracts that are not closed or settled on a particular day. The option interest rises as new contracts are opened, and falls as they are closed or liquidated. So, it differs from the trading volume, which is increased by both opening and closing trades.

It's worth noting that open interest is not real-time trading data, as opposed to trading volume, which is calculated in real time. Open interest has around a 7-hour lag because the Options Clearing Corp (OCC) calculates it only after the market closes. For example, suppose you are checking the quote details of the below option contract within the trading session. The open interest of 3288 only tells you how many options were open at the previous trading day's close. Less than an hour after the close, you can see the real open interest of that trading day on Webull.

Why use open interest?

1, High open interest represents higher liquidity

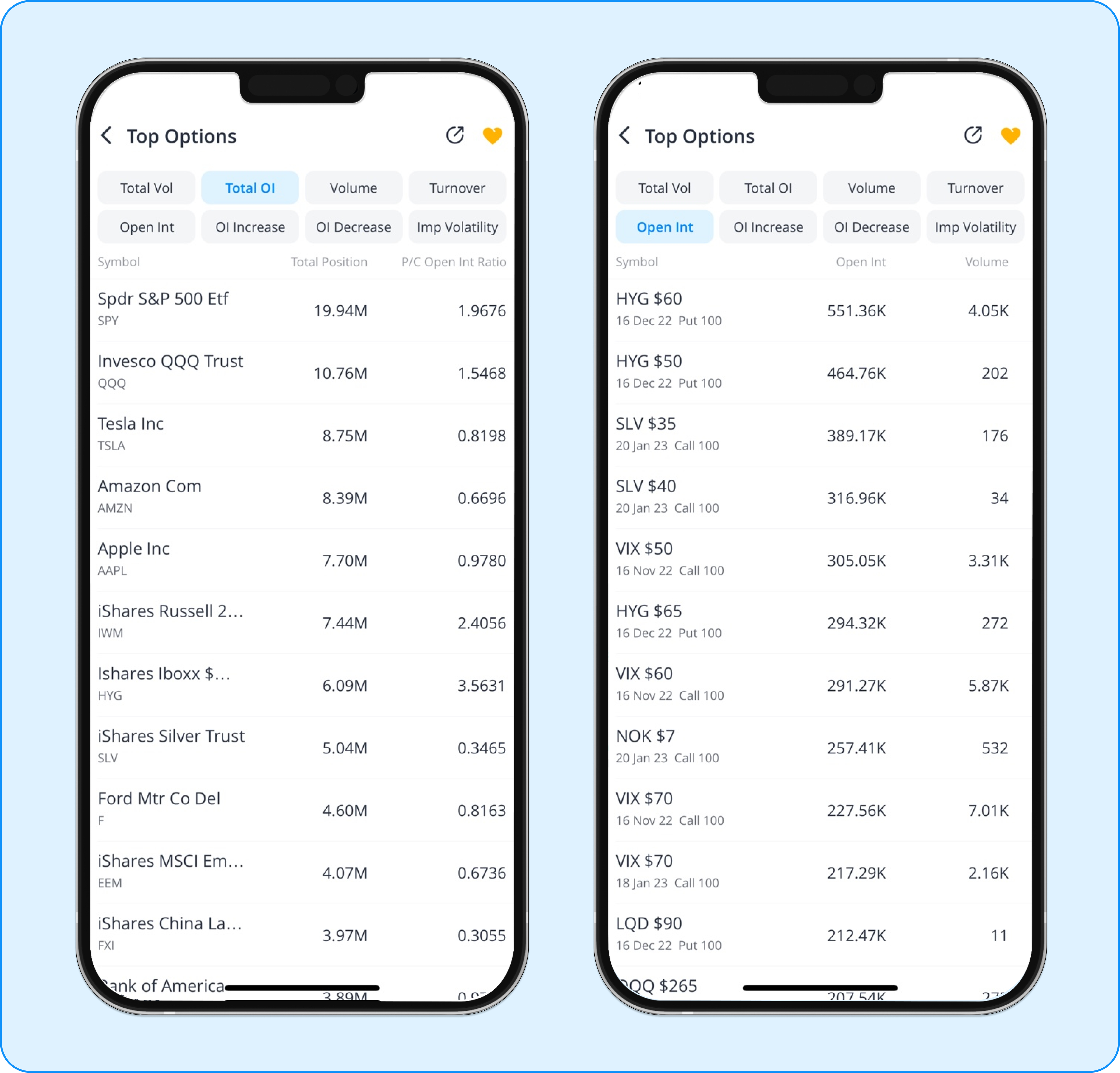

Taking a closer look at the options chains, you will see that the open interest distribution varies by strike or expiration date. Longer expiration or deep ITM/OTM options generally have lower open interest, meaning they are less frequently traded and less liquid. Some retail investors may pay more attention to those symbols with high open interest for the higher liquidity and the likelihood of their orders being filled at an acceptable price.

Webull provides two types of lists that rank the open interest from high to low according to underlying symbol and individual option contracts.

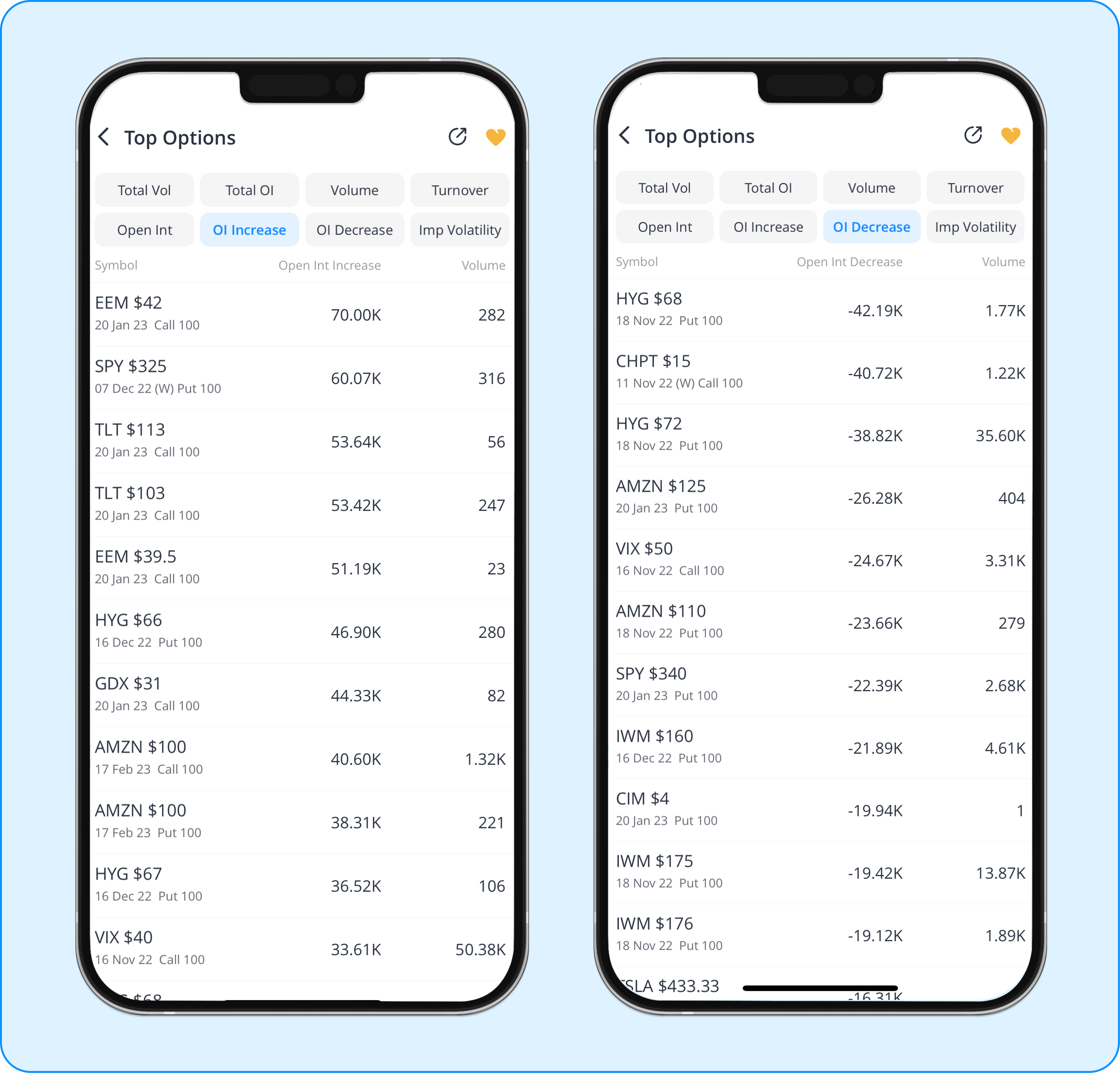

2, Changes in Open Interest can alert you to unusual activity

Some conclusions can be drawn about market activity by analyzing changes in the open interest figures, we can draw some conclusions about market activity. Large increases in open interest means new money is pouring into the market, possibly indicating that the present market momentum (up, down, or sideways) is likely to continue. A big decrease in open interest suggests money surging out and may imply that the current price trend is coming to an end. Of course, open interest is only one indicator. There are many factors at play in option pricing, and no single variable can be relied upon without context.

- Open Interest Increased List: ranks individual option contracts with the largest increased open interest from the previous trading day.

- Open Interest Decrease List: ranks individual option contracts with the largest decreased open interest from the previous trading day.

The bottom line

High open interest or stark changes in open interest can indicate unusual behavior on a given option contract. However, this alone does not predict price movement. In combination with other metrics, such as the Put/Call ratio, investors can get deeper insights into market sentiment, and make more informed investment decisions.

Tap here to get started with paper trading on the latest version of the app!

Disclosure: All trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.