Top Options List Quick View

The Top Options List help investors understand options market dynamics.

AuthorWebull Learn

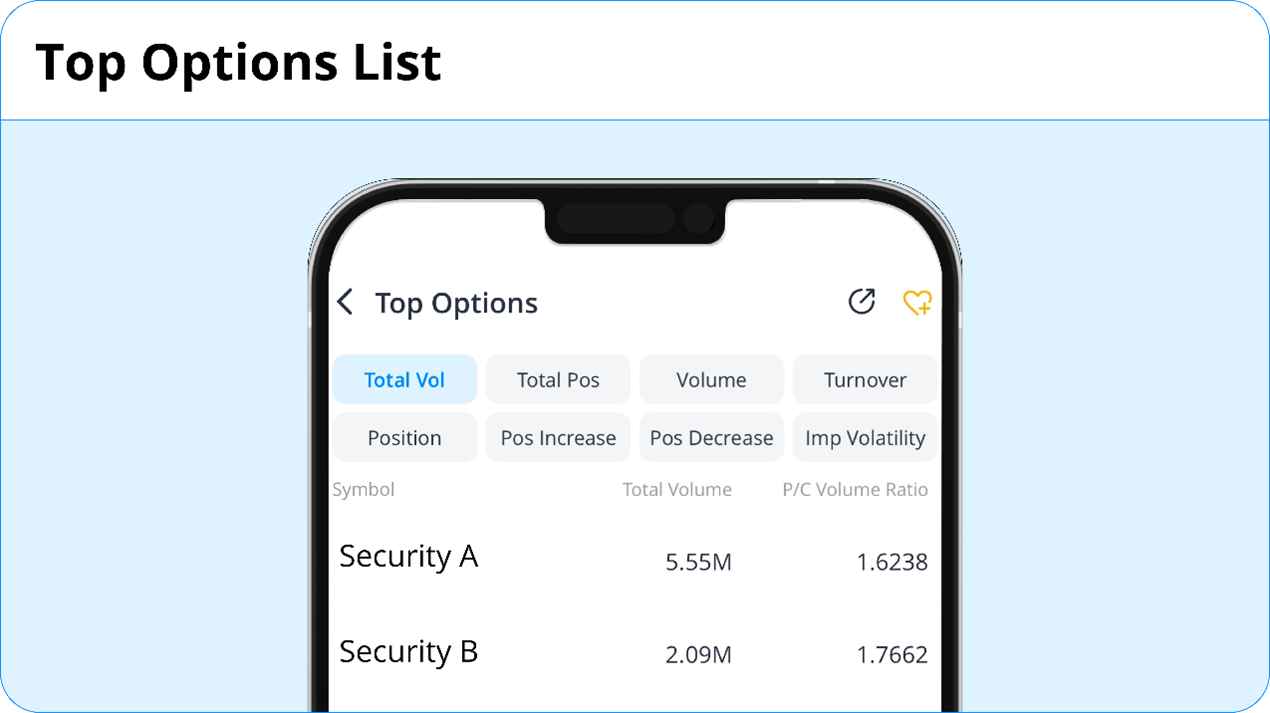

Webull provides options ranking lists based on different filtered conditions to help investors monitor the changes in the options market. The Top Options List is concise and informative—let’s take a look!

There are currently eight supported conditions for our users:

- Total Volume List ranks the underlying security according to the total volume for all options contracts (across all expiration dates and strikes) traded during the trading day.

- Total Position List shows the top securities with the highest open interest at the end of the trading day.

- Volume List ranks the most bought and sold options contracts by the trading volume from high to low.

- Turnover List ranks each options contract in order by the total premium amount spent on buying options or received from selling options.

- Position List ranks each options contract based on their current open interest from high to low.

- Position Increase List ranks individual options contracts with the largest increased open interest from the previous trading day.

- Position Decrease List ranks individual options contracts with the largest decreased open interest from the previous trading day.

- Implied Volatility List shows the individual options contracts with the highest implied volatility.

Next Step: Get Started

For OPRA subscribers, you have real-time quote information for the Top Options Lists. Non-subscribers will have a 15-minute delay.

There are two ways to access it:

1. You can click here for our latest mobile version.

2. Or, you can scroll down on the market page and find it yourself, as shown below.

0

0

0

Disclaimer: Options are risky and not suitable for all investors. Investors can rapidly lose 100% or more of their investment trading options. Before trading options, carefully read Characteristics and Risks of Standardized Options, available at Webull.com/policy. Regulatory, exchange fees, and per-contract fees for certain option orders may apply.

Share your ideas here…

Lesson List

1

Quick Overview: Long Call Option Strategy

Top Options List Quick View

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2026 Webull. All Rights Reserved