GTC for Options Trading

When you're placing a trade, you must choose a Time-in-Force: Day or Good 'Til Canceled (GTC). Today, we will talk about GTC for options trading. How much do you know about GTC? Let's find out!

What is a GTC Order?

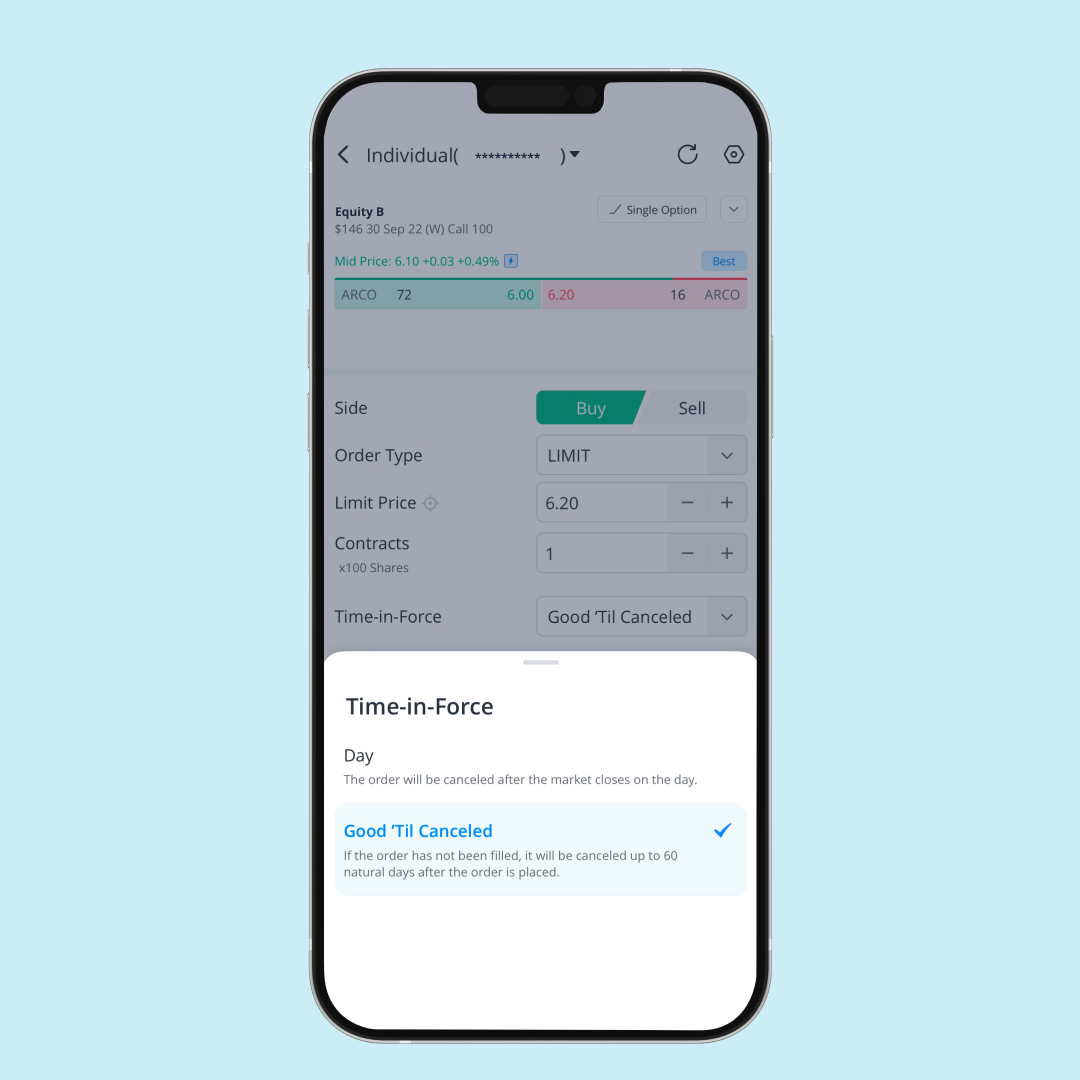

A Good-Til-Canceled (GTC) order lasts until the order is completed or canceled, in contrast to a day order, which will automatically expire if not filled by the end of that trading day. On Webull, all open GTC orders expire 60 calendar days after they are placed. You can place GTC orders during both regular trading hours and extended hours (from 4:00 am to 8:00 pm EST on business days) or weekend, and you can modify or cancel your open GTC orders anytime.

Here are some tips you should note before trading options with GTC.

- Options trading is not available for extended hours, but you can place a GTC order during this time. Your order can fill as early as the next trading day.

- GTC orders for options contracts will be automatically canceled if the contract expires.

- In the event of any corporate action (stock split, exchange for shares, or distribution of shares), all open GTC orders will generally be canceled.

How the GTC works?

Suppose you want to invest in contract B with an expiration date of Sep 30, which is currently trading at a market price of $6.00. You place a limit order at $5.50 and choose a GTC order.

There are two possible scenarios:

- Market price falls below $5.50 within 60 days and your limit order is triggered. The order will be filled at $5.50 or below.

- The market price keeps rising and fails to reach $5.50. The pending order will expire automatically after 60 days. The order will also be cancelled if the contract expires during that time.

Why Use GTC for Options Trading?

- Helpful tool for watching the market

Like options alerts, GTC orders can also help you watch the market when busy with work or other things. You don't need to sit at your computer or watch your phone all the time, because the GTC order will be automatically triggered once the price is reached during the trading period.

- Save your time

Some investors prefer GTC because they only need to place a trade once, and the trades will be filled whenever the contract price reaches the target price, rather than resubmitting the same order every day until it's successful. However, unlike GTC orders for stocks, option contract orders will not fill outside of regular trading hours.

Scenario for Using GTC Order

Most people work during trading hours, so they can’t closely monitor price changes throughout the day. If you want to invest in contract B with an expiration date of Sep 30, which is currently trading at a market price of $6.00, but you want to buy the contract at $5.00, a GTC order can help you achieve this without taking up as much of your time.

You can also place a GTC order during the weekend. It can be filled as early as when market opens the following Monday.

Bottom Line

If you want your order to last longer so that you don't need to place it multiple times, use a GTC order. You can cancel or modify the order any time before it is filled.

What's Next

Try out paper trading to gain options trading experience at no cost!