If you’re following Precigen (PGEN), you know it’s not every day a biotech firm captures Wall Street’s attention like this. The spark? Precigen recently scored FDA approval for Papzimeos, its therapy for adults with recurrent respiratory papillomatosis. This is the first approved treatment for a condition that previously had few good options, setting the stage for both a clinical impact and a new revenue stream.

The FDA greenlight sent Precigen’s stock surging over 300% year-to-date, an extraordinary run even for high-risk biotech. Since the news broke, Wall Street sentiment has shifted, with at least one major upgrade and continued optimism, balanced by reminders of regulatory hurdles ahead. In addition, Precigen recently lined up $125 million in credit, strengthening its balance sheet just as new commercial opportunities open up.

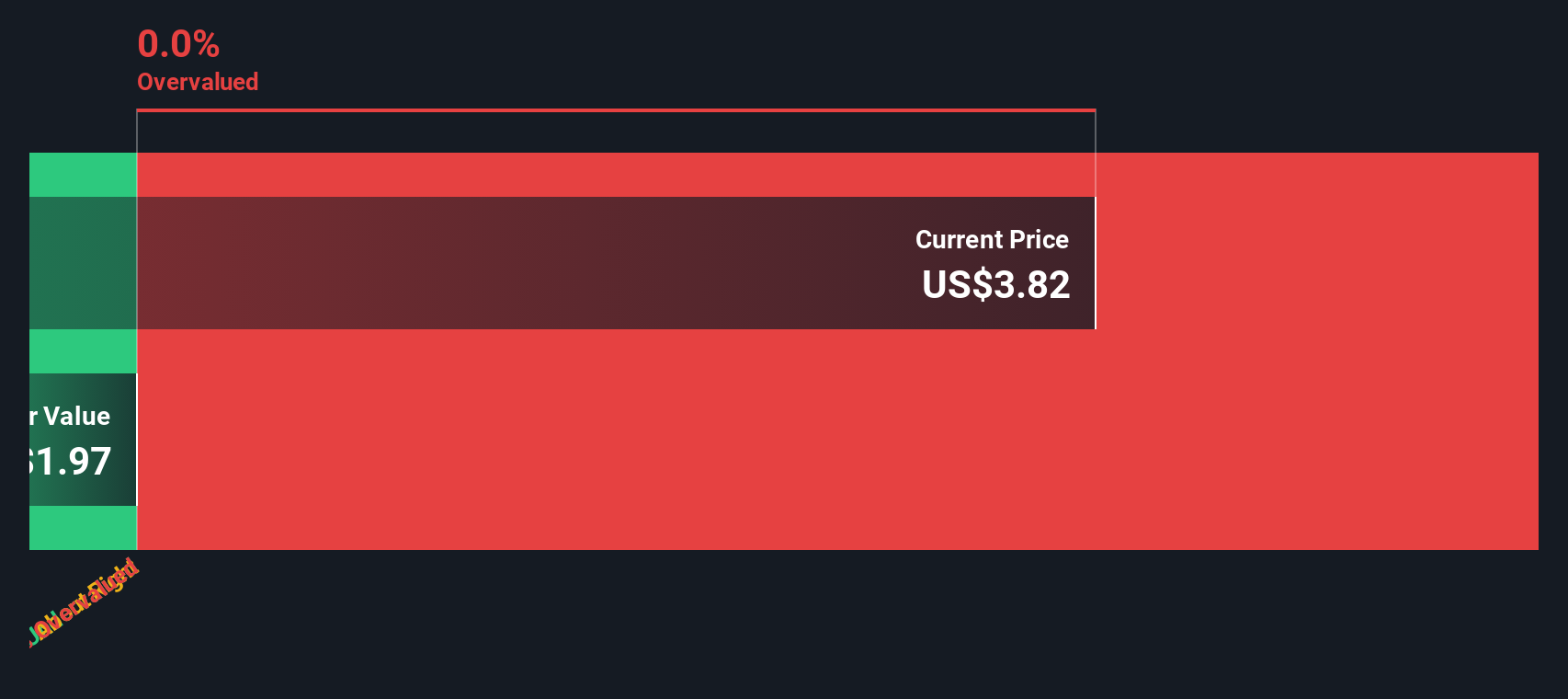

After this kind of move, investors are left weighing a big question: does Precigen’s current price reflect its future potential, or could the market still be underestimating what comes next?

Price-to-Book of -30.7x: Is it Justified?

Precigen currently trades at a price-to-book (P/B) ratio of -30.7x, compared to the US Biotechs industry average of 2.2x. This deep negative ratio stands out in valuation assessments.

The price-to-book ratio compares a company’s market value to its net asset value. This provides investors a quick sense of how the market values the firm’s equity relative to its underlying assets. For biotechs in particular, this measure can be volatile due to heavy investment and uncertain future profitability.

In Precigen’s case, the negative equity driving this ratio reflects accumulated losses, not asset strength. The market’s willingness to pay up despite this may signal expectation for future breakthroughs or strong growth potential. It also means current fundamentals deviate from industry norms.

Result: Fair Value of $30.53 (UNDERVALUED)

See our latest analysis for Precigen.However, significant risks remain, including regulatory challenges and the possibility that future earnings may not meet market expectations, even though the company has achieved recent milestones.

Find out about the key risks to this Precigen narrative.Another View: DCF Tells a Different Story

Looking at our DCF model provides a different lens on Precigen’s valuation. Although the market multiple suggests one perspective, this method points to a distinctly different fair value. Could the true outlook be somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Precigen Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can shape your own view in just a few minutes by starting here: Do it your way

A great starting point for your Precigen research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investing Ideas?

Make the most of your momentum by checking out other standout opportunities we’ve uncovered. The next big mover could be waiting where you least expect it.

- Spot uniquely priced shares with real upside when you check out undervalued stocks based on cash flows hiding in plain sight.

- Target income you can count on by starting with dividend stocks with yields > 3% offering reliable yields and consistent performance.

- Fuel your portfolio’s growth potential by sifting through AI penny stocks powering tomorrow’s breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

All Comments